As a farm worker, am I entitled to earn at least the minimum wage?

BC’s main employment standards law sets out rules employers must follow in paying their workers. Some of these rules apply differently to farm workers. Learn your rights around getting paid as a farm worker.

What you should know

Under the law in BC, a farm worker is a person who works in a farming, ranching, orchard, or agricultural operation, and whose main responsibilities are:

growing or picking crops, or raising or slaughtering animals,

cultivating land,

using farm equipment,

cleaning, sorting, or packing crops, or

selling farm products on site.

A farm worker doesn’t include a worker who:

processes the products of an operation,

works in aquaculture or a retail nursery, or

works as a landscape gardener.

Farm workers are covered by most sections of the Employment Standards Act, the main provincial law that protects workers. See our information on farm workers’ rights for more on their rights under this and other laws.

“My brother and I work on a farm picking blueberries and strawberries. We’re paid by piece rate, and we were earning $0.30 a pound for both crops. A community worker told us this was below the legal minimum. We brought it up with our employer, and they agreed to boost our rates. Sometimes it pays — literally — to know your legal rights.”

– Terry, Abbotsford, BC

Minimum wage is the lowest wage an employer can pay a worker. The minimum wage for farm workers depends on how they’re paid.

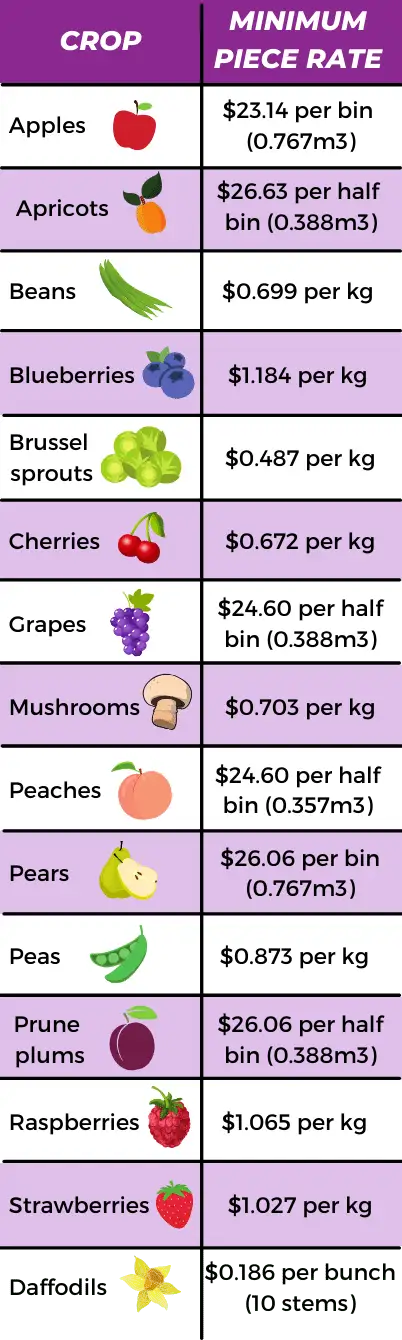

Farm workers who harvest specific crops by hand may be paid by piece rate. The minimum piece rate is set by the BC government and varies depending on the crop. For example, the minimum piece rate is different for harvesting a pound of raspberries than for a pound of beans. A bin of apples and a bin of grapes have different rates.

As of January 1, 2024, the minimum piece rates are:

* The rate for daffodils does not include vacation pay.

All other farm workers, whether they’re paid hourly, by salary, or by any other method must be paid at least the general minimum wage. As of June 1, 2024, the general minimum wage is $17.40 per hour.

An employer cannot wait until the end of the harvest season to pay farm workers. An employer must pay workers at least twice a month. A pay period cannot be longer than 16 days.

Hourly and salaried farm workers must be paid all wages within eight days of the end of the pay period.

Farm workers paid by piece rate must be paid at least 80% of total estimated wages owing at the middle of each month. All remaining wages must be paid within eight days of the end of the month.

If an employer fires a farm worker or lays them off, the employer must pay the worker all wages owing within 48 hours of letting them go.

If a worker quits, the employer must pay them all wages owing within six days of when the worker quits.

We offer guidance on your rights when leaving a job.

All farm workers are excluded from statutory holiday pay entitlements. As well, farm workers aren’t entitled to overtime pay.

Most workers in BC are entitled to vacation pay. This is an extra 4% or 6% of a worker’s earnings, to provide them with pay while absent during vacation. (The percentage depends on how many years they’ve worked.)

Most farm workers paid by piece rate are not entitled to vacation pay, as it’s included in the piece rate. The exception is for farm workers harvesting daffodils — the piece rate for them doesn’t include vacation pay, so it should be paid on top of the piece rate.

Farm workers paid by the hour or by salary (or who pick daffodils) are entitled to vacation pay.

On paydays, an employer must give each farm worker a written wage statement that includes:

the employer’s name and address

the number of hours worked

the worker’s wage rate, whether hourly, salary, piece rate, or other

any money, allowance or other payment the worker is entitled to

the amount and reason for each deduction

how the worker’s earnings are calculated (if they aren’t paid hourly or by salary)

the worker’s gross and net wages

The document must be separate from the worker’s pay cheque. An employer doesn’t need to provide a wage statement if nothing has changed since the last pay period.

Keep track of your hours and earnings

Keep your own records of the hours you work and the wages you get. If you think you weren’t paid enough, your own records will help prove the hours you worked and what you earned.

A farm labour contractor helps agricultural producers connect with and hire farm workers. The workers might work on a variety of farms owned by different producers.

If a farm labour contractor hires you, the contractor — not the farmer — is your employer.

A farm labour contractor must clearly display the wages being paid to farm workers, in multiple places. This includes all work sites and in all vehicles used to transport workers. The contractor must pay a worker’s wages directly to their bank account by direct deposit.

Work out problems

If you haven’t been paid what you’re owed, raise the issue with your employer. Show them any documents that support your position (for example, a record of the hours you worked).

See our step-by-step guidance on if your employer hasn’t paid you.

If discussing the problem with your employer doesn’t work, try writing a letter. Explain your concerns in detail. For example, you could say something like:

“Under the law in BC, I’m entitled to be paid at least semi-monthly. It’s been seven weeks since the start of the harvest, and I still haven’t received my wages. The delay is affecting my ability to pay my bills on time. [Modify to fit your situation.] I’d like to explore solutions to this issue with you as soon as possible.”

We provide tips for writing a letter to your employer.

Keep a copy of the letter for your files. Having a written record will be useful if you need to take additional steps.

If you aren’t able to resolve things directly with your employer, you can make a formal complaint. Workers covered by the Employment Standards Act can make a complaint to the Employment Standards Branch. This government office administers the Act and helps workers and employers resolve problems.

Note, though, that farm workers aren’t covered by certain sections of the Act. For example, the rules on overtime pay don’t apply to farm workers. That means a farm worker can’t complain to the branch to try to recover overtime wages.

For what’s involved, see our guidance on making an employment standards complaint.

Common questions

The law doesn’t limit the hours that farm workers can work, but it does say an employer cannot let a worker work excessive hours or hours that could harm their health or safety.

If a farm labour contractor takes you to a worksite and then there is no work, the contractor must pay you for the longer of:

two hours, or

the time it takes to go from the starting point to the worksite and back (or to another place that’s a similar distance and acceptable to you).

If work is not available because of bad weather or another cause beyond the control of the contractor, you aren’t entitled to be paid.

No. A farm labour contractor must not charge a worker for hiring or obtaining work for that person.

No. An employer can’t require a worker to pay any portion of the employer’s cost of doing business. As well, an employer can’t deduct or offset a worker’s earnings except for statutory deductions required by law, or with the written authorization of the worker.

No. The minimum wage for workers is the same for everyone, regardless of age.

An employer who wishes to hire a young person under age 16 must get written consent from the young person’s parent or guardian. They may also need to get permission from the Employment Standards Branch. See our guidance on how old you have to be to work in BC.

Who can help

Employment Standards Branch

BC government office that deals with complaints against employers and farm labour contractors.

Access Pro Bono's Free Legal Advice

Volunteer lawyers provide 30 minutes of free legal advice to people with low or modest income.

Access Pro Bono’s Everyone Legal Clinic

Clinicians provide affordable fixed-fee services on a range of everyday legal problems.

Lawyer Referral Service

Helps you connect with a lawyer for a complimentary 15-minute consult to see if you want to hire them.

BC Legal Directory

Search for a lawyer by community or legal issue. From the Canadian Bar Association, BC Branch.