“Our family was hit with unexpected bills, and we needed some extra money. I went to a payday lender, and was approved for a loan in minutes. They made it seem so easy. And then I learned how much I would be paying in interest. I was shocked. I decided to ask my parents for a loan instead.”

– Allie, Surrey, BC

You have rent coming due, extra bills piling up, and you’re strapped for cash. Taking out a payday loan can be a tempting short-term solution. However, your cost of borrowing is through the roof. And relying on payday loans can get you into deeper financial trouble. Thankfully, there are other options to borrow money in a pinch.

Five reasons to avoid payday loans

Payday loans are small, short-term loans. The maximum amount that can be borrowed is $1,500 and usually, they have to be repaid within 14 to 28 days.

They’re also seductively easy to get. Payday lenders don’t ask to see your credit report before lending to you. They just want to see proof you’ve got a source of income and your bank account details.

But you pay dearly for that quick access to cash. Most payday lenders charge much higher interest rates and fees than other lenders.

Under the law in BC, the most a payday lender can charge you for a loan is 15% of the principal amount borrowed. This includes interest and any other fees.

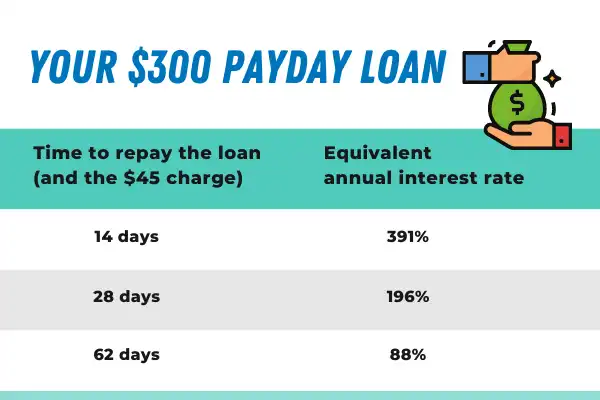

This might not sound like a lot. But it is a very expensive way to borrow money. If you take out a $300 payday loan, that 15% charge will be $45. This translates into a very high annual percentage rate of interest, particularly if the loan is for a short period of time.

Let’s unpack this a little more. The annual percentage rate of interest tells you how much it costs to borrow for one year. That 14-day payday loan has a heart-stopping rate of 391%. In comparison, the rate on a typical bank credit card is around 20%.

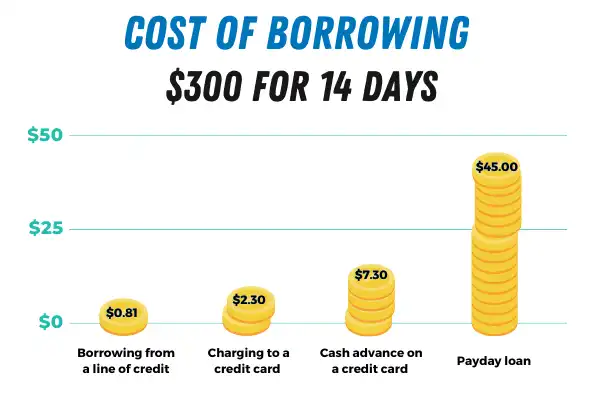

Put another way, taking out a 14-day payday loan is roughly 20 times as expensive as using a credit card, and 50 times as expensive as borrowing from a line of credit.

The costs shown in this example are based on the following:

The annual interest rate charged on borrowing from a line of credit is typically 7%.

The annual interest rate charged on making a purchase with a credit card is typically 20%.

The annual interest rate charged on taking a cash advance with a credit card is typically 20%, in addition to a $5 fee.

A payday loan costs $15 per $100 that you borrow; for a 14-day loan, that translates to an annual interest rate of 391%.

If you can’t repay a payday loan on time, the lender can add extra charges to your loan.

The law in BC says that a lender can charge interest at a rate of 30% per year on any amount outstanding after the loan is due.

As well, the lender can charge a one-time $20 fee for any dishonoured cheque or pre-authorized debit.

Some payday lenders will tell you, without being asked, the maximum amount you’re eligible to borrow. (They can’t lend you more than 50% of the net income you receive during the term of the loan.) Some will encourage you to borrow to your limit. This will make it harder to pay back the loan. Which can quickly lead to an endless cycle of getting a new payday loan to repay the one you got last week.

Some payday lenders ask for a payment up front before you can borrow money. They aren’t allowed to do this.

Some payday lenders urge you to buy “loan insurance” at an extra cost. By law, they’re not allowed to require or request from you such insurance.

(To protect borrowers, the law in BC sets out a number of things payday lenders are not allowed to do. Learn more about how to protect yourself if you are getting a payday loan.)

Payday loans can be enticing: they provide quick access to cash, at convenient hours and locations, with no credit check. Most people taking out a payday loan intend to pay it back in full quickly, typically in a few weeks. But when you're paying so much in interest, it can be difficult to do so.

Many end up taking out a new loan to pay off the first. Most people who borrow from payday lenders end up taking out multiple loans.

Under BC law, payday lenders aren’t allowed to grant "rollovers." A rollover is where a lender gives you a new loan to pay off an existing loan. But borrowers can seek out a new lender. And many do. Credit counsellors report that clients with payday loans typically have three to five loans when they arrive for counselling, skirting the rules by going to rival lenders for new loans.

The result can be an endless cycle of high-cost debt. It's even got a name: the payday loan cycle.

There are other (less expensive) options

One of the best options if you need money right now is a new credit card. Most major banks offer promotional rates for the initial month or two. Paying down your credit before the promotional period ends is a good approach to save money and build your credit score.

If you have bad credit, one option is taking out a secured credit card. Many major banks offer secured credit cards to higher-risk borrowers. The approval process for these cards is much less strict. However, the issuer usually requires a cash deposit as a guarantee of on-time payment.

A line of credit is another good option. Consider opening a small ($10,000 or so) line of credit when you don’t need it and have good credit. (If your credit rating takes a hit later on and you need money, you may not qualify for a line of credit.) Open it, but don’t use it. This will allow you a “safety net” you can use instead of taking out a high-interest credit card or payday loan.

If you've taken out a payday loan

You may be able to cancel

If you’ve already taken out a payday loan, you may have the right to cancel it. You can always do so within two business days of taking out the loan. You may even be able to cancel the loan outside of the two-day cooling-off period if the lender didn’t cross their t’s and dot their i’s. See our guidance on cancelling a payday loan.