If a worker signs something saying they're an independent contractor, they're considered an independent contractor under the law.

An independent contractor is a worker who’s self-employed. Under BC law, they're treated differently than employees. Figuring out which category you fall into is important. The answer affects your legal rights, steps you can take to enforce them, and how you pay income tax. We step you through the factors that go into determining whether you're an independent contractor.

What you should know

“When I was just starting out as an independent contractor, I learned some important lessons the hard way. One was that I don’t have the same protections as an “employee.” Now, when I start working with a new client, I take extra care to make sure our agreement is airtight. As they say, the best offence is a good defence.”

– Rhegan, Port Moody, BC

The BC Employment Standards Act, the main legislation in the province that protects workers, only applies to employees. Independent contractors aren’t covered by it. That means they’re left out of the kinds of basic minimum entitlements employees typically get. For example, they aren’t entitled to vacation pay or job-protected leaves from work.

As an independent contractor, you can still take steps to enforce your rights, but the process is different (usually harder) than it is for employees. If you aren’t paid for your work, for example, you may have to go to court to try to get your money. (Whereas an employee might simply file a claim with the government office that enforces the Employment Standards Act.)

The distinction is also important for tax purposes

The distinction between employees and independent contractors is also important for tax purposes. Independent contractors can deduct certain business expenses on their tax return. The CRA provides guidance on how they decide who’s an independent contractor for tax purposes.

While the BC Employment Standards Act doesn’t include a definition for “independent contractor,” it does define “employee.” The definition is very broad, and is meant to cover as many work relationships as possible.

You’re seen to be an employee under this law if any of the following apply:

You perform work for someone else for a wage. This applies regardless of whether you’re employed full-time or part-time, whether the work is temporary or permanent.

An employer allows you to perform work normally done by an employee. This can be done directly or indirectly. For example, if an employee asks you to cover their shift, you’re an employee. Even if your employer doesn’t know about this arrangement.

You’re being trained by an employer for their business. This includes job shadowing, trial periods, and any training that happens prior to starting regular work.

You’re on leave from an employer. This includes maternity or parental leave, or illness or injury leave.

You have a right of recall. This can come up if you’re temporarily laid off. It means you get to return to work.

Meanwhile, the Employment Standards Act defines an employer as someone who has “direction or control of an employee.” This is important. It’s one of the key factors used to determine if you’re an independent contractor or an employee. We explain the key factors next.

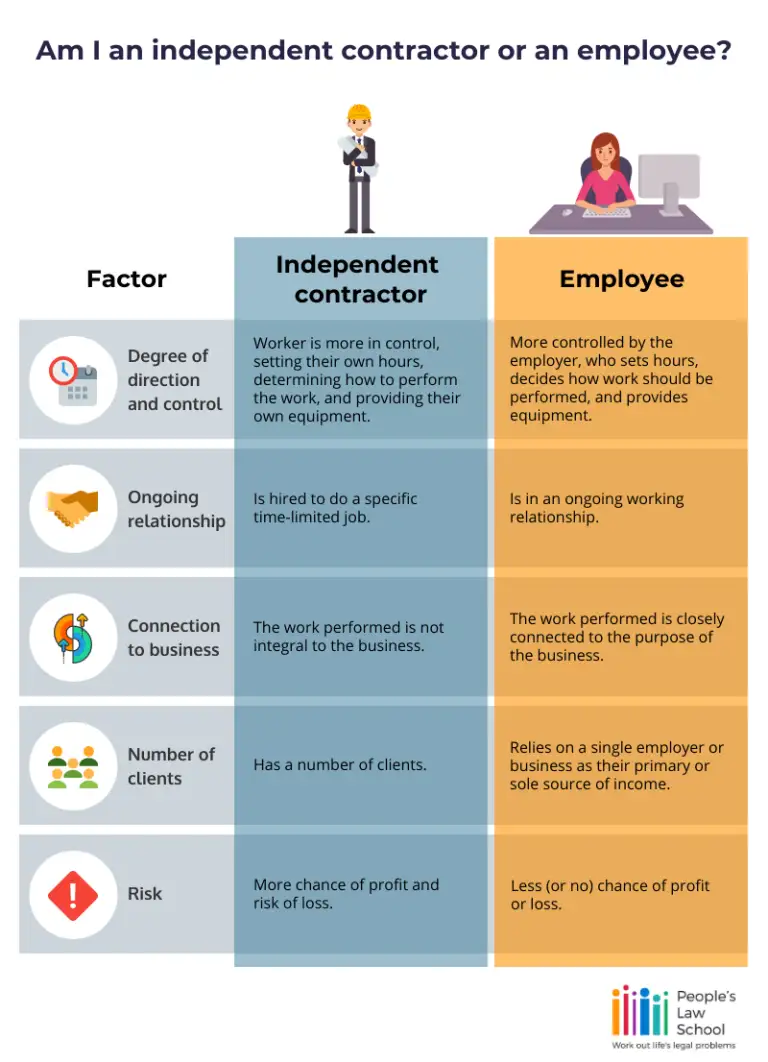

The question of whether someone is an employee or an independent contractor can be tricky. There are several factors in play.

One is direction and control. Does the employer call the shots or do you? Under the Employment Standards Act, an employer is a person who has “control or direction of an employee.” If the person paying you directs the work and says how it’s done, that leans towards you being seen as an employee.

Independent contractors are less controlled by the employer. A contractor would be more likely to set their own hours, determine how to perform the work, and provide their own equipment.

Other factors include:

Clients. Is the person paying you your only gig?

Ongoing relationship. Have you worked for them for a long time?

Connection to business. Is the work you do closely connected to the purpose of the business?

More “Yes” answers mean you are more likely to be seen as an employee than as an independent contractor.

Here are key factors in the inquiry. One way of bottom-lining it: Whose business is it? If it’s your business, you’re an independent contractor.

Sample scenarios

The Employment Standards Branch is the government office that enforces the Employment Standards Act. They provide a couple of scenarios that give you a sense of how the factors play out in deciding whether someone is an independent contractor or employee. Below we provide a few scenarios of our own, to help you figure out which category you might fall within.

When in doubt

In BC, workers are covered by the Employment Standards Act unless an exception applies. If there’s any doubt whether an exception applies, it is resolved in favour of the worker. The Act applies. It’s intended to protect as many workers as possible.

The result: any doubt as to whether a worker is an independent contractor should be resolved in their favour.

The courts in BC have recently recognized a third category of worker — the dependent contractor. This type of work relationship falls somewhere between an employee and an independent contractor. Generally, a dependent contractor is an independent contractor who relies mostly (or entirely) on a single employer for work.

In determining whether you fit this bill, the courts will look at several key factors:

Whether you work primarily for a single employer.

How much control the employer has over you and your work.

Whether you rely on tools the employer provides.

Whether the company makes deductions from your pay for things like income tax or employment insurance.

Whether you have a risk of loss or possibility of profit.

Whether you play an essential role in the business.

The length of the work relationship. (The longer the term of service, the more dependent you’re considered to be.)

How much you and your employer rely on and coordinate with each other.

If you’re a dependent contractor

Like independent contractors, dependent contractors aren’t covered by BC’s main employment law, the Employment Standards Act. However, the courts have said that dependent contractors should have the same rights as employees when it comes to notice of termination. That is, an employer must provide “reasonable notice” if they’re laying you off. We explain the rules around how much notice or severance pay you’re entitled to.

You may be an "employee" even if you sign something saying otherwise

Just because you sign something saying you’re an independent contractor doesn’t mean you are one. The courts will look behind the label of your position to decide if you’re dependent or not.

Independent contractors can become dependent over time

If you’re hired as an independent contractor, you may transition to a more dependent position over time. This could occur as you gradually take on more responsibilities within the company.

For example, say you’re hired by a company as an independent contractor to do their bookkeeping. In the beginning, you’re just updating the company’s accounts. But over time, you become more involved in preparing financial statements and recording transactions. This shift in duties could suggest that you’ve transitioned to a dependent contractor.

When you’re an employee, your employer deducts money from your pay cheque to cover your income tax owing. If they’ve taken the correct amount, your tax bill should be $0 at tax time. If they deduct too much (meaning you overpaid your taxes), you get a tax refund from the government.

When you’re self-employed, you’re entirely responsible for paying your tax bill. That means you need to think ahead and set aside enough money in advance.

Self-employed workers pay taxes on their business earnings after deducting expenses. That means they’re allowed to subtract certain expenses from their total annual income. The net amount is what they pay tax on. We go into more detail in our guidance on self-employment.

Often, employers prefer to label workers “independent contractors” rather than “employees.” They may do this to avoid having to follow the legal rules that apply to employees. But even if your employer calls you an independent contractor (or you sign something saying you are), you may still be considered an employee under the law.

The following factors aren’t enough, on their own, to establish that you’re an independent contractor:

you agree to be an independent contractor

you charge GST

you work at more than one job

you submit invoices instead of time cards

you don’t have statutory deductions taken from your earnings

you work independently without much supervision

you drive your own car

you provide your own tools

you are paid by piece rate or commission

Ask your employer to clarify your employment status

If you start a new job and you’re unsure about your employment status, ask your employer for clarification. If they call you an independent contractor and you disagree that you are one, raise the issue with them. Getting this straightened out right away can prevent problems down the road.

Figure out if you’re an independent contractor or employee

There are several key factors that go into determining whether you’re an employee or independent contractor (see above). To get a sense of how these factors come into play, let’s look at some real-world examples.

As you read through the following scenarios, think about your own situation. Pick out any points that fit with your own circumstances. By comparing your own story to these, you’ll have a better idea of which category you fall into.

Jeremy is a freelance writer. He was recently hired by a marketing firm to write blog posts for their website. Under his contract, Jeremy agreed to publish one blog post a week. Jeremy’s contract with the firm is for six months, with an option to renew it if the firm likes his work. This is his only paid gig.

Three days a week, he works from home using his own laptop. One other day, he works from the firm’s office and uses a desktop computer they provide. When he works from home, he’s free to set his own hours. On days where he’s in the office, the firm requires him to work regular business hours (9 to 5).

Jeremy is an independent contractor because:

For the most part, he’s in control of how and when he does the work.

He can do the work without any tools provided by the firm.

His employment relationship with the firm isn’t ongoing.

Shania works for a locally-owned food delivery company. When she was hired, she signed an agreement saying she’s an independent contractor. The company assigns Shania to a specific region, where she’s responsible for deliveries and generating sales. She’s paid by commission, at a rate set by the company. She uses her own car to get around, but the company requires her to display its logo on it.

Shania’s allowed to set her own hours, as long as her deliveries are made between 8am and 7pm on weekdays. She uses a tablet computer and order forms the company supplies. She also works for a ride-hailing company two or three hours a week.

Shania is an employee because:

The company has direction and control of her work. (They decide where and when she works. And they require her to display the company logo on her car.)

She’s in an ongoing relationship with the company.

She’s doing work that is core to the work of the business.

She relies significantly on supplies provided by the company to do her job (the tablet computer and order forms).

Andrew works for a landscaping company during the summers while he attends college. The company decides what projects Andrew works on, and when he needs to arrive at the job site. They provide most of the tools and equipment, but Andrew is responsible for his own transportation. He’s paid an hourly rate set by the company. When he signed on, his boss told Andrew he’s an independent contractor.

Despite what his boss said, Andrew is an employee, because:

The company has direction and control of his work. (They tell him where to work, and when he needs to arrive. And they set his hourly rate of pay.)

The company provides most of the tools and equipment he uses in his work.

He’s doing work that the company is in the business of doing.

He faces no personal risk of loss or chance of profit.

Who can help

Employment Standards Branch

Can help clarify whether you're considered an independent contractor or employee under provincial employment standards law.

Employment and Social Development Canada

They can help if you work in a federally-regulated industry.

Access Pro Bono's Legal Advice Clinics

Volunteer lawyers provide 30 minutes of free legal advice to people with low or modest income.

Access Pro Bono’s Everyone Legal Clinic

Clinicians provide affordable fixed-fee services on a range of everyday legal problems.

BC Legal Referral Service

Helps you connect with a lawyer, notary or paralegal for a free 15- to 30-minute consult to see if you want to hire them.

BC Legal Directory

Search for a lawyer by community, area of law, or language spoken. From the Canadian Bar Association, BC Branch.