Earning employment income makes you ineligible for welfare benefits.

Lack of available jobs, disability, low wages, inflation, a family breakup. These are among the many reasons someone may need financial help. If you’re struggling to afford your basic needs, you may qualify for welfare. Here, we explain your rights and walk you through the steps to apply for income assistance.

Who is eligible

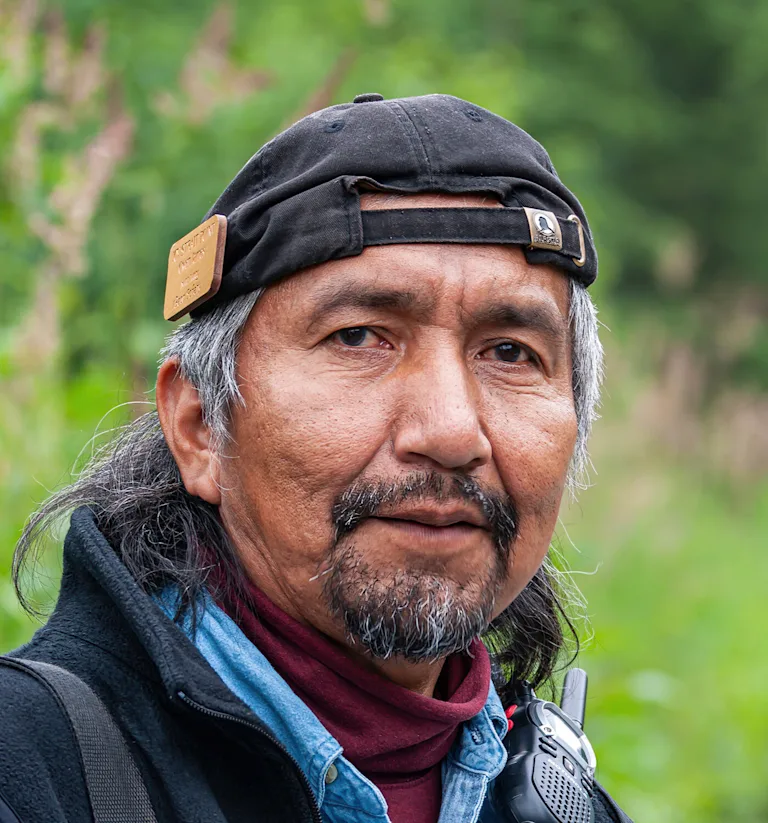

“A year ago, I scaled back my work to look after my daughter. Rent has gone up, and so has everything it seems. We’re barely scraping by. I reached out to an advocate. They told me I may qualify for welfare, even though I work part-time. I’m thinking about it — I could really use the support right now.”

– Derrin, Vancouver, BC

Welfare benefits provide financial support to those in need. The benefits are provided by the provincial government, through the Ministry of Social Development and Poverty Reduction. In this guidance, we refer to it as the ministry.

There are four types of welfare benefits available in BC. We explain them here. They are:

Income assistance, which provides a support and shelter allowance to those on a low or no income.

Disability assistance, for those with a severe mental or physical impairment that restricts their ability to perform daily living activities.

Benefits for persons with persistent multiple barriers to employment (PPMB), for those with a medical condition and other barriers that make it difficult or impossible to look for work or keep a job.

Hardship assistance, for those in need who, for specific reasons, don’t qualify for any of the three welfare benefits listed above.

In the guidance below, we focus on income assistance. Elsewhere, we cover applying for disability benefits.

If you live on reserve

If you live on reserve in BC, you are not eligible for welfare from the ministry. Instead, a social development worker at your band’s office can help you with your application for financial assistance from the federal government. See Legal Aid BC’s guidance on income assistance on reserve.

BC law sets out rules around who qualifies for income assistance. You may be eligible if any of the following apply:

you’re out of work or not earning enough to meet your basic needs

you’re waiting for other sources of money to arrive

you can only work very little, or not at all

you urgently need food, shelter or medical attention

Welfare is considered a “payer of last resort.” This means that to qualify, your income and assets must be below certain levels. More on this in a moment.

There are four main eligibility criteria for income assistance:

asset limits

income limits

immigration requirements

age requirements

We’ll explain each in turn.

If you intend to apply for the persons with disabilities designation

Income assistance applicants who intend to apply for the persons with disabilities (PWD) designation are subject to different asset rules. They can qualify for income assistance as long as they meet the higher asset limit that applies to disability assistance applicants. See our guidance on applying for disability benefits for details.

To qualify for income assistance, the value of your assets must be below a certain amount. This amount is called your asset limit. Under the law, an asset includes:

equity in any personal or real property that can be converted to cash

a beneficial interest in personal or real property held in trust

cash

Asset limits vary depending on the size of your family unit. Your family unit includes you and your dependents. A spouse (married or unmarried) who lives with you is a dependent. So is a minor child who lives with you more than half the time and relies on you for necessities, like food and shelter.

Who is considered a spouse

Under BC’s welfare laws, a spouse is someone:

you’re married to, or

have declared you’re in a marriage-like relationship with, or

have lived with for at least one year in a marriage-like relationship.

Indicators of a marriage-like relationship include sharing finances and presenting as a couple to friends and family. See this guidance from the province for details.

Older relatives and adult children don’t count as your dependents, even though they may live with you and depend on you for care. They can apply for welfare as their own family unit if they need to.

Assets are classified as exempt or non-exempt

When the ministry looks at your assets, some of them don’t get counted towards your asset limit. The law calls these exempt assets. Examples include clothing, one vehicle, and your family unit’s home. Assets that do get counted towards your asset total are called non-exempt assets. The ministry’s website has the full list of exempt and non-exempt assets.

To qualify for welfare, the value of your non-exempt assets must be below your asset limit. Visit the ministry’s website for current asset limits for income assistance. (Note the higher asset limits for disability assistance.)

To qualify for income assistance, your family unit’s net income must be below a certain amount. This amount is called your income limit. Your income limit is equal to the amount your family unit would receive on income assistance. To get a rough idea of your income limit, see the current income assistance rates.

If you qualify for other financial support

If the ministry thinks you’re eligible for other benefits, they may ask you to apply for them before you apply for welfare benefits, or while you are receiving welfare. Examples include employment insurance, workers’ compensation, and Canada Pension Plan benefits.

If the ministry asks you to apply for benefits you don’t think you qualify for, it’s a good idea to speak to an advocate. See below, under who can help.

Income is classified as exempt or non-exempt

Under the law, some sources of money don’t get counted towards your net income. This is called exempt income. Examples of exempt income include:

EI maternity and parental benefits

Canada child tax benefits

child support payments

Indigenous financial settlements

Income that does count towards your total net income is called non-exempt income. Examples of non-exempt income include:

CPP benefits

regular EI and EI sickness benefits

pension plan benefits

spousal support payments

See the ministry’s website for the full list of exempt and non-exempt income.

If you have non-exempt income

If you have non-exempt income that’s less than the assistance rate your family unit would get, the ministry will pay you enough to make up the difference.

For example, say you have a spouse and one child who live with you. You determine that your family unit would get $1,500 per month in income assistance. Your family unit takes in $1,100 per month from other non-exempt sources. In this case, if you qualify, the ministry would pay you $400 in income assistance for the first month. That is, unless you’re entitled to an earnings exemption.

You get a monthly earnings exemption

Those on income assistance can earn some income from work without having it deducted (taken) from their monthly payments. This is called an earnings exemption. Usually, you become eligible for an earnings exemption after receiving income assistance for one month. But if someone in your family unit received income assistance or disability assistance in one of the last six months, the earnings exemption will take effect right away.

The amount of your earnings exemption depends on what type of welfare you get and the size of your family unit. As of December 2025, the monthly earnings exemption for a single person on income assistance is $600.

For current earnings exemption amounts, visit the ministry’s website.

BC law sets out immigration requirements you must meet to qualify for income assistance. To be eligible, at least one member of your family unit must be one of the following:

a Canadian citizen,

a permanent resident (with landed status),

a Convention refugee,

in Canada under a temporary residence permit,

in the process of having a claim or application for refugee protection decided,

subject to a removal order that cannot be executed, or

in Canada under a temporary resident visa issued for humanitarian reasons related to armed conflict.

An exception to the immigration requirements

The law carves out an exception to the above requirements for single parents without legal status in Canada who are separated from an abusive spouse. To qualify for the exemption, the welfare applicant must:

have one or more children who are Canadian citizens

be separated from an abusive spouse

have applied for permanent residence status in Canada

be unable to leave BC for specific reasons

For the full details, see the ministry’s website.

If your sponsorship breaks down

If your spouse sponsored you to come to Canada and your sponsorship breaks down due to abuse, you may be able to skip some of the usual steps when applying for welfare. See our guidance on sponsorship breakdown.

Different age requirements for disability assistance

Under the law, you can qualify for the persons with disabilities (PWD) designation and start receiving disability assistance at age 18. This is the case even if you still live with your parents. See our guidance on applying for disability benefits for details.

Generally, you must be age 19 or older to qualify for income assistance.

However, if you’re under age 19, you may qualify in these circumstances.

If you don’t live with your parents. To be eligible for welfare, the ministry must be convinced that your parents won’t support you. The ministry will make reasonable efforts to get your parents to take responsibility for your financial support before giving you benefits.

If you live with your parents. If your parents receive welfare benefits and you have a dependent child of your own, the ministry may see you as a separate family unit from your parents. This means you can apply for welfare as your own family unit and receive benefits separate from your parents.

What you should know

In applying for welfare benefits, you have rights. These include the right to:

apply for and get the benefits you qualify for

fair, efficient, and respectful service from ministry staff

get extra help from ministry workers if you need it for health or other reasons

have your privacy and personal information protected by the ministry

have someone with you when you talk to a ministry worker (for example, an advocate, friend, or family member)

ask for an interpreter if English isn’t your first language

appeal or challenge most ministry decisions that go against you

It’s not your fault that you’re struggling to meet your needs. You have the right to ask for help — it’s not something to feel ashamed of.

When you first contact the ministry to apply for welfare, they will do an immediate needs assessment. The purpose of the assessment is to find out if you have an immediate need for food, shelter, or urgent medical attention. You have the right to get support right away if you need it.

Circumstances that show an immediate need include:

relying on community resources (like a food bank) for basic food needs

having received an eviction notice

having had your utilities disconnected, or facing a disconnection

staying at an emergency shelter with no suitable accommodation to move into in the near future

being unable to pay for prescription medication you need right away

If the ministry agrees you have an immediate need, they will ensure you get help as soon as possible. They will also speed up the welfare application process, and relax some of the eligibility requirements for you.

If you are fleeing abuse

When you apply for welfare, let the ministry know right away if you’re fleeing abuse. Ministry staff should ensure that the immediate safety needs of you and your children are met. They can also speed up the application process, to ensure that you don’t stay in an abusive situation due to financial need.

Sometimes, dealing with the ministry can be hard. Here are a few tips when dealing with ministry staff:

If you need help understanding something, talk to an advocate or reach out to a friend. An advocate is a community worker trained to help people. It can help to have someone else to talk to the ministry on your behalf. To find an advocate in your area, see below under who can help.

Call the ministry back if you don’t hear from them when you’re supposed to. We tell you the deadlines in the steps below.

Keep notes of what you do, including the date and time. When you contact the ministry, ask for the name of the person you speak to and write it down.

Ministry staff must follow BC’s welfare laws. You can access the laws that deal with income assistance here and here. There are also policies and procedures ministry staff must follow. You can access them here. Consider contacting an advocate if you need help understanding what the laws or policies mean.

Be persistent. Remember: you have the right to get help.

Apply for benefits

The process to apply for welfare depends on the type of benefits you’re applying for. In this guidance, we describe the steps to apply for income assistance. (Elsewhere, we cover applying for disability benefits.)

When you apply for welfare, you need to give information about your current situation. Before starting your application, gather documents showing:

how much you pay for rent and utilities

if you have a vehicle, how much you owe on it (if anything)

how much money you have in the bank

if you’re currently working, your income from work

if you’re getting or waiting for other income (like employment insurance, child or spousal support, workers’ compensation benefits, Canada Pension Plan benefits, or other benefits)

if someone sponsored you to come to Canada

You should also be ready to provide details about yourself and the members of your family unit. This includes:

personal ID for you and your family

your social insurance number

a phone number so the ministry can contact you

It’s time to start your application. You can apply in one of three ways: online, by phone, or in person. We’ll explain the process for each.

Apply online

The platform to apply for welfare online is called My Self Serve. To use it, you’ll need to register for a free account. Once you sign in, you’ll receive instructions guiding you through the process.

You can save your progress (keep your answers) at any time during your application. If you aren’t sure about an answer, make your best guess. You can change it later. If you need help, you can call the ministry at 1-866-866-0800.

After you apply, make sure to check your My Self Serve account often. The ministry sends important messages there. If you aren’t going to be able to check a My Self Serve account regularly, or you don’t feel comfortable using a computer, you can apply for welfare by phone or in person.

If you don’t own a computer

If you don’t have internet access or your own computer at home, some places have computers you can use for free. Depending on where you live, you may find computers at:

community centres

offices where advocates work (see who can help, below)

Apply by phone

You can contact the ministry by phone to apply for welfare. Their number is 1-866-866-0800. You won’t be charged for the call.

A ministry worker will ask you questions to find out if you have immediate needs or if you’re fleeing abuse. The ministry aims to phone you back and fill out the application with you within three business days. You’ll get a number called an application service request number. Write it down, together with the name of the worker you talk to.

Within five business days of completing your application over the phone, you’ll need to sign the application in person at a ministry or Service BC office. Find an office location near you.

Another option is to ask the ministry worker to fax your completed application to a trusted third party like an advocate, social worker, or doctor. You’d have to sign the application in front of that person within five business days.

It’s a good idea to keep a copy of your signed application form for your records.

Apply in person

You have the right to go to a ministry office in person for help if you need it. For example, if you have trouble using a phone or don’t have a computer. Here is a list of ministry office locations.

When you apply in person, a ministry worker will ask you some questions right away to find out if you have immediate needs or if you are fleeing abuse. Tell the worker if you are in either of those situations. What happens next depends on whether you have access to a phone.

If you have a phone, the ministry aims to phone you to complete the application with you within three business days. From here, you’ll follow the same steps as someone who applies by phone, described above. If you don’t have access to a phone, you’ll get an appointment time to meet with a ministry worker in person. At your appointment, the worker will help you fill out your application.

When you apply for welfare, you have to do an orientation. Your orientation will explain:

eligibility requirements for income assistance

the information you need to provide to the ministry

the work search requirement (explained next)

tips and resources to help you find a job

other sources of income that may be available to you

If you start your application by phone or in person, the ministry worker will tell you what you need to know for your orientation. If you apply online, the orientation is included as part of the application process.

The requirement to complete an orientation is waived for some applicants, including those over age 65 and those with a disability that prevents them from completing an orientation.

“When I applied for income assistance, I was told I needed to do a work search in order to qualify. I’d been out of the job market for months, and was feeling discouraged. The ministry worker handling my file suggested I visit a WorkBC centre. I found one nearby, and met with one of their employment experts. She’s been very supportive. We’re working together to help me rejoin the workforce.”

– Joel, Quesnel, BC

Under BC law, most applicants for welfare must complete a work search to qualify for benefits. You can satisfy this requirement in one of two ways:

complete a three-week work search after starting your application for welfare and before attending your eligibility interview, or

show that you already completed a three-week work search in the 30-day period before starting your welfare application.

You may not need to complete a work search in some circumstances, including if:

you’re fleeing an abusive spouse or relative

you’re a single parent of a child under age three

you’re 65 or older

you can’t legally work in Canada

you have a disability that prevents you from looking for work

The ministry has a full list of exemptions.

If you have an immediate need

If the ministry determines you have an immediate need for food, shelter, or urgent medical care, you might still need to do a work search. But you may receive hardship assistance in the meantime. We explain hardship assistance in our guidance on the welfare benefits available.

What does a work search involve?

The ministry says a reasonable work search involves activities like:

looking for jobs on the internet, by phone, in the newspaper, and asking around

writing a résumé and going to résumé-writing classes

applying for jobs

accessing employment services and going to employment agencies

going to job fairs and workshops

attending job interviews

You must keep a record of your work search activities using this form. Look for a WorkBC Centre near you for help with your work search.

If the ministry isn’t satisfied with your work search, they may ask you to redo it. Or they may refuse to pay you welfare. If that happens, it’s a good idea to speak to an advocate. See below, under who can help.

If you are fleeing abuse

Welfare applicants who are fleeing abuse are exempt from the work search requirement. If this applies to your situation, you will proceed directly to the eligibility interview (described below). In the meantime, the ministry will work to ensure that your safety needs are met. See the ministry’s website for more.

Once you’ve done your orientation and work search, you’ll attend an eligibility interview. This is the last step in the welfare application process. At the eligibility interview, the ministry looks at your situation and decides if you qualify for welfare.

Generally, the ministry should schedule your interview for a date within five business days of when you contact them.

If you applied for welfare online, you may not need to have an eligibility interview. The ministry may be able to decide whether you are eligible just by reviewing the information you submitted through My Self Serve.

Preparing for your interview

Start by gathering the documents you’ll need for your interview. Here’s what you’ll need:

Personal identification for you and your family members. Each applicant must provide two pieces of ID (one must be photo ID, like a driver’s licence). For dependent children, only one piece of ID is required.

Your social insurance number and your spouse’s social insurance number (if applicable).

Records showing benefits or wages you earn now. For example, recent pay stubs, government benefits receipts, or your income tax assessment.

Statements for all of your bank accounts from the last two months.

Lines of credit you have by yourself or with someone else.

Financial records for any registered accounts, like RRSPs or RRIFs.

Life insurance policies.

Any family law documents, like court orders or agreements for spousal or child support.

Registration documents for any vehicles you own.

What to expect at your interview

Your eligibility interview may take place over the phone or in person. Either way, the process is mostly the same.

The ministry worker will collect your information and enter it into their computer system. They may ask you questions about your work history and work search (if you had to do one). They may ask for additional information if they need it.

At the end of the interview, you’ll be asked to sign a form. Before signing, read through the form and make sure all the information is correct. If you notice an error, ask the ministry worker to change it. Do not sign a form that has wrong information on it.

You’ll also have to sign a consent form. This form says the ministry can check the information you provided in your application. It gives them permission to exchange information with other government agencies and social service providers if needed.

Lastly, the ministry worker may ask you to do a client needs assessment. This is a tool the ministry uses to determine your readiness to work and identify any barriers to employment. After the assessment, they may ask you to enter an employability plan. Your employability plan outlines what you agree to do to find a job and get hired. For example, it may include attending a job placement or training program.

Not all recipients of income assistance have to do a client needs assessment or enter an employability plan. For example, those age 65 or older are exempt. So are single parents with a dependent child under age three.

If the ministry tells you your information isn’t complete

If the ministry worker says your application has information missing, ask them exactly what they need. Write down what they say. Ask them if they need the information by a certain date. If so, write it down. If you need more time to gather the required information, contact them before the deadline and ask for an extension.

On learning of the ministry’s decision

If the ministry worker says you don’t qualify for welfare, ask for the reason in writing. Ask them if you are eligible for hardship assistance. This is a type of support available to those who, for specific reasons, don’t qualify for welfare.

If you disagree with the ministry’s decision on your case, you can ask for a reconsideration. We explain how next.

Under the law, you can ask the ministry to reconsider their original decision on your case. With a reconsideration, a separate department of the ministry reviews your information to ensure you’re getting the right benefits. You can request a reconsideration if:

your application for assistance or a supplement was denied

your assistance or supplement was reduced

your assistance or supplement was stopped

If your request relates to a decision to reduce or stop your assistance or supplement, the ministry may agree to continue paying you your monthly benefits or supplement while you wait for the outcome of the reconsideration. This is called a reconsideration supplement. Usually, you have to pay back the supplement if your reconsideration fails.

You can’t ask the ministry to reconsider a decision involving service quality or administrative issues. For these problems, contact an income assistance office to speak to a supervisor.

Find an advocate

Advocates are community workers trained to help people. An advocate can tell you if your reconsideration or appeal is likely to succeed. They can also help you with the paperwork involved. To find an advocate, see below under who can help.

How to request a reconsideration

First, call the ministry at 1-866-866-0800 or visit your local ministry office to tell them you want a decision reconsidered. They should give you a request for reconsideration form within 48 hours. If you haven’t received the form within a week of your request, follow up with them. (Note that it’s generally best to pick up your reconsideration package in person to prevent delays.)

Fill out sections three and four of the form, then return the form to your local office. Alternatively, you can fill out and submit a request for reconsideration form online through My Self Serve.

To ensure the ministry has all the information you want them to consider for your reconsideration, submit the completed form together with any new evidence you might want to provide. New evidence can include an updated personal statement, letters from doctors or assessors, statements from others, or tests and medical records.

Make sure to meet the deadlines

You must return the form within 20 business days of the ministry’s original decision. The 20 business day countdown starts the day after you learn of the decision. If your denial decision is dated but you did not read or receive the decision until days later, the 20 day deadline should start the day after you actually learned of the decision. If there was a delay between when your decision is dated and when you found out about the decision, it’s important to tell the ministry this when you call to request the reconsideration package. They should amend the dates accordingly.

If you aren’t able to meet the 20 day deadline, you can request an extension of up to an additional 20 business days. The countdown for the extension deadline starts the day after you request the extension. To maximize your time, make sure you request your extension as close to the original deadline as possible. If you request your extension too early, it can eat into your original timeline and will not provide you any additional time.

What happens next

A reconsideration officer will review your form and should get back to you with a decision within 10 business days. If you used My Self Serve, the reconsideration decision will be posted there. If not, it will be sent by mail. Follow up with the ministry if you have not received a decision on your reconsideration after a week.

If you aren’t satisfied with the reconsideration decision, you can appeal. Welfare appeals are heard by the Employment and Assistance Appeal Tribunal.

Who can help

The Ministry of Social Development and Poverty Reduction

Government office that administers BC’s welfare program.

WorkBC

Government agency offering employment services to British Columbians.

BC Ombudsperson

Independent office that hears complaints about government services or agencies.

PovNet

Legal advocates provide free legal information and help to low-income people in the community, under the supervision of a lawyer.

Together Against Poverty Society

Helps people in the Greater Victoria area with PWD applications and challenging ministry decisions.

Community Legal Assistance Society

Assists low-income British Columbians who need help with a decision from the Employment and Assistance Appeal Tribunal.

UBC Law School's Student Advice Program

Law students provide help to people with limited means in the Vancouver area.

University of Victoria Law Centre

Law students provide help to people with limited means in the Victoria area.

Thompson Rivers University Community Legal Clinic

Law students provide help to people with limited means in the BC Interior.